Introduction: A New Economic Rhythm?

For decades, economists taught that economies follow predictable boom-and-bust cycles: periods of expansion followed by recession. However, recent behavior of the U.S. economy—in the face of severe shocks such as the 2008 financial crisis, the COVID‑19 pandemic, inflation, and trade disruptions—has cast doubt on this model’s applicability in today’s conditions. The traditional business cycle may be losing its relevance in modern America

1. Why the Model Is Changing

A. Improved Policy Firepower

Analysts emphasize that modern monetary and fiscal tools have significantly dampened recessions. The Federal Reserve now acts faster and more decisively, deploying interest rate changes and large-scale quantitative easing programs totaling over $6 trillion since 2008. Simultaneously, federal stimulus—like the $831 billion Recovery Act and over $4 trillion in COVID-era relief—helped absorb shocks and sustain confidence

B. The Great Moderation & Technological Shifts

Since the 1980s, economic variability has declined—a period dubbed the Great Moderation. Inflation became more controllable, recessions less frequent and severe, while real GDP, employment, and production stabilized. Technological advances and globalization also helped moderate traditional price and demand swings

C. Structural Economic Transformation

The U.S. economy is now dominated by services and technology, not manufacturing or agriculture. Service-driven economies are less cyclical by nature—consumer service spending comprises roughly 70% of GDP, and is more resilient to economic shocks. BlackRock strategist Rick Rieder likens the modern economy to a satellite—circling steadily rather than crashing back to earth

Inflation levels at cycle ends have dropped significantly since pre-1990 highs, further reducing economic turbulence during downturns .

2. Viewing Evidence Through Modern Lenses

A. Patterns of Expansion & Recession

Historically, expansions lasted on average 33 months, and recessions were more frequent and deeper. Post‑1980, recession frequency declined, and expansions stretched into eras—with some spanning 90–120 months. Contractions became less dramatic and briefer in duration

B. Inflationary Control at Cycle Peak

Earlier business cycles typically ended with inflation above 5%. Modern cycles conclude with lower inflation—thanks to better policy coordination and improved CPI measurement that reduces housing and borrowing volatility in price indexes

C. Financial Markets as the New Pressure Valve

As monetary and fiscal power increased, cyclical stress has shifted from the real economy to financial markets. High valuation multiples, credit expansions, and debt dynamics now substitute for inflation spikes as signs of excess—highlighting imbalances in markets more than in output .

3. Voices Arguing That the Cycle Might Be “Over”

Seema Shah & The Times

Shah calls the U.S.’s recent resilience—weathering crises with no prolonged recession—a sign the traditional cycle may be obsolete. Unless policy capacity is undermined by rising inflation or debt, the cycle’s regularity might give way to idiosyncratic shocks rather than systemic downturns .

Rick Rieder & JPMorgan

Rieder contends that the typical early/mid/late‑cycle framework is outdated. He asserts that modern economic performance resembles satellites in steady orbit—they dip and recover, but rarely crash. With durable consumer spending and resilient services, true recessions may only follow extraordinary shocks

Capital Group’s Benjamin Button Analogy

Economist Jared Franz likened the U.S. economy to Benjamin Button—aging in reverse—shifting from late to mid-cycle, avoiding recession. He projects growth at 2.5–3% and sees a low likelihood of recession before 2028; such expectations would imply a cycle redefined, not collapsed

Other Influences

BlackRock’s 2025 outlook notes that many former bears (like Nouriel Roubini) now echo cautious optimism, suggesting traditional valuations and recession signals may no longer apply in the tech‑driven modern era

4. Why Skeptics Doubt the Cycle Is Gone

Deutsche Bank’s View

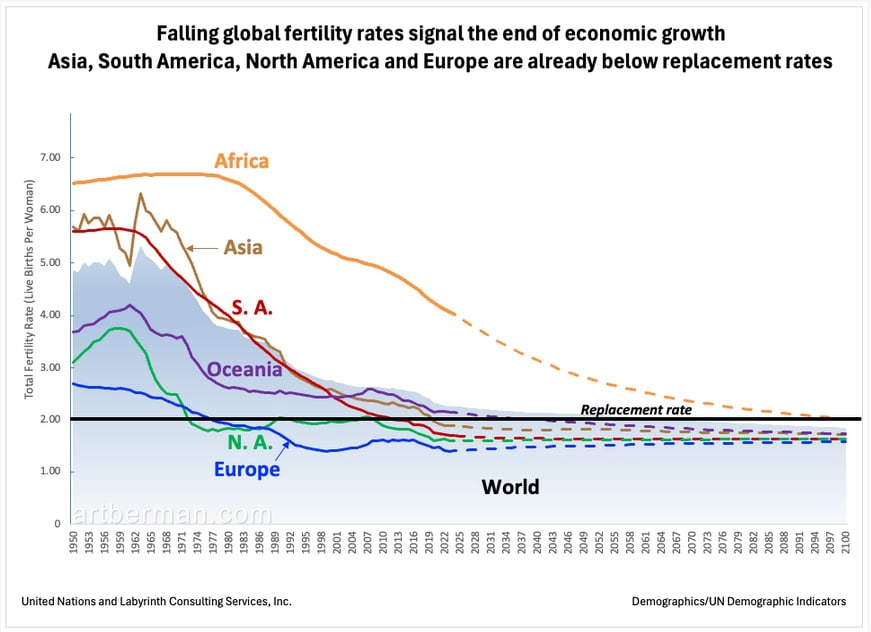

Deutsche Bank economists argue we may not have exited cycles—but recessions may become more frequent but milder. They forecast that heavy fiscal debt and demographics may force a return to periodic downturns—even if shorter—within the next decades

Barron’s Warning

Even if cycles appear extinct, opinion pieces remind readers that markets remain volatile and vulnerable. Risk remains, and overreliance on steady policy support may backfire if shocks exceed intervention capacity

BIS Concept of the Financial Cycle

The Bank for International Settlements posits that economic danger now comes from longer financial cycles, not short real cycles. Credit buildup and asset bubbles may span decades, eventually erupting across multiple traditional cycles—and disrupting the illusion of stability

5. What This Means in Practice

A. Monetary and Fiscal Tool Overuse

Modern cycles rely heavily on policy responses. But rising public debt, persistent inflation, and central bank fatigue could compromise future response. If intervention capacity wanes, so may the model that currently smooths recessions .

B. Real Economy vs Market Fragility

Though real GDP remains stable, equity markets remain sensitive to exogenous shocks, valuations, and investor sentiment. As real cycles diminish, financial cycles may dominate—and endings may arrive through market corrections, not broad-based economic downturns.

C. Role of Structural Shifts

Unlike the past, tech innovation, AI, globalization, and services offer transformable yet stable growth drivers. But equitable gains and sustained productivity improvements are essential to displace traditional cycle volatility entirely.

6. Key Indicators to Monitor

Analysts suggest watching:

| Indicator | Why It Matters |

|---|---|

| Debt-to-GDP ratio | Rising debt limits policy flexibility |

| Inflation persistence | Sticky prices could force unwelcome Fed tightening |

| Market volatility metrics (e.g. VIX) | May signal financial cycle strain |

| Wage and household debt growth | Reflect whether credit cycles are overheating |

| Consumer spending trends | Service-led stability vs sudden consumption pullback |

7. Long-Term Outlook: What Comes Next?

- If shocks remain moderate and policy remains nimble, U.S. economy may continue orbiting in a low-volatility regime.

- If inflation spikes or fiscal headroom erodes, the cycle may reassert dramatically—though possibly with less intensity.

- Global or structural shocks—such as geopolitical conflict, climate crisis, or financial breakdown—could puncture this model abruptly, regardless of structure.

Conclusion: Reinventing, Not Replacing, the Cycle

Evidence suggests the U.S. economy is undergoing a transformation: a shift from boom-bust cycles to a steadier orbit underpinned by policy buffers and structural change. But cycles may not be obsolete—they may simply be evolving.

Policymakers have constructed an economic firewall. Yet that firewall depends on sustained fiscal discipline, cooling inflation, and forward momentum from innovation—especially in productivity and labor markets. Financial cycles may become the dominant stress test, replacing macro cycles as sources of volatility.