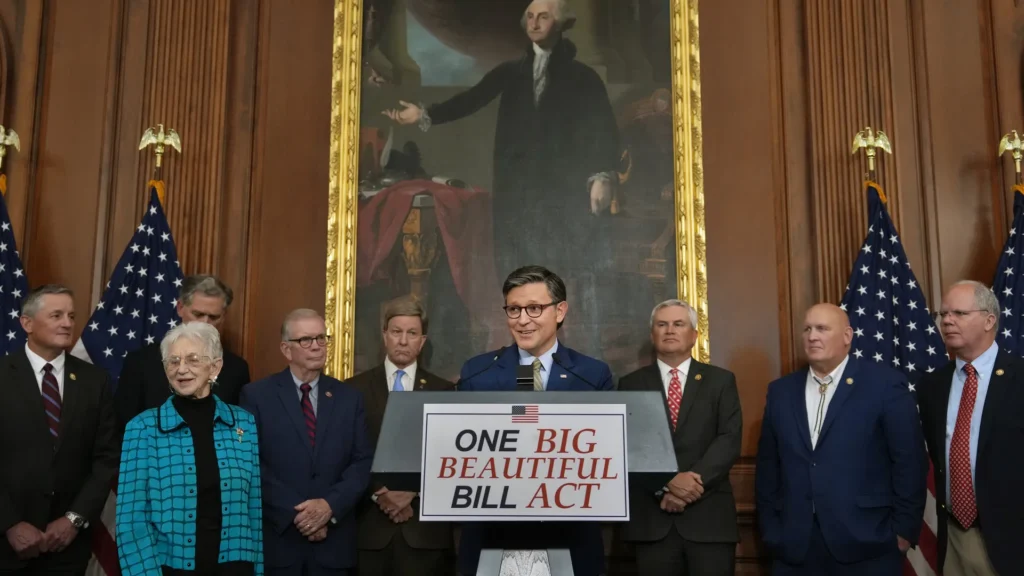

A sweeping legislative package with historic stakes

On July 4, 2025, President Donald Trump signed the sweeping One Big Beautiful Bill Act (“Big Beautiful Bill”) into law—an 800‑page legislative package that extends key tax cuts from his 2017 Tax Cuts and Jobs Act (TCJA), introduces new individual and business tax breaks, reduces funding for social welfare and clean energy programs, and raises defense and border enforcement spending.⁽¹⁾ The legislation also raises the federal debt ceiling by $5 trillion.⁽²⁾ Critics warn the bill will balloon the national deficit by $3–4 trillion over the next decade and push the debt-to-GDP ratio toward 126% by 2034, or even higher.⁽³⁾

This article explores the provisions, projected macroeconomic impacts, and longer-term risks of the bill amid growing fiscal concerns.

1. What’s in the Bill: Tax Cuts, Deductions, and Spending Trade‑Offs

Tax Benefits and Extending the TCJA

- Permanent extension of the 2017 individual tax rates and brackets.

- Expanded standard deduction and lifted SALT caps (up to $40,000 for income below $500K, reverting later).⁽⁴⁾

- New temporary deductions for tips, overtime pay, auto loans, and parental “Trump Accounts” set to expire in 2028.⁽⁵⁾

Business and Investment Incentives

- Permanent full expensing of short-lived assets and R&D investments, reducing the tax penalty on capital investment.⁽⁶⁾

- Enhanced pass-through deductions for small businesses and semiconductor manufacturing credits.⁽⁷⁾

Spending Cuts and Reallocations

- $1‑$1.7 trillion in cuts to Medicaid and food assistance programs, potentially stripping health coverage from over 11 million Americans and reducing SNAP eligibility for 8 million more.⁽⁸⁾

- Elimination of key clean energy tax credits under the Inflation Reduction Act.⁽⁹⁾

- Massive new allocations for border enforcement and defense ($150 billion each).⁽⁴⁾

Republican proponents argue the bill aligns with an “America First” economic agenda—promoting growth while slashing waste.⁽¹⁰⁾

2. Estimated Economic Impacts: Growth vs. Debt

Short‑Run Boost, Long‑Run Drag

The nonpartisan Congressional Budget Office (CBO) forecasts a modest 0.5% GDP boost over the first decade, peaking at 0.9% in 2026, driven by elevated consumer demand and investment.⁽¹¹⁾ However, rising interest costs—estimated to increase by $441 billion over 10 years—offset much of that benefit.

CBO projects public debt rising to 124% of GDP by 2034, as deficits widen by roughly 7 percentage points of GDP.⁽¹¹⁾ Similarly, models from Yale’s Budget Lab show real GDP peaking short‑term, then slowing: by 2054, GDP could be 2.9% lower than if the bill had not passed due to crowding out.⁽¹²⁾

Conflicting Assessments

- The administration’s Council of Economic Advisers (CEA) paints a more optimistic picture: 2.4–2.7% GDP growth by 2034 and maintaining stable debt-to-GDP by assuming robust behavioral responses—though many analysts question these assumptions.⁽¹¹⁾

- Tax Foundation, AEI, and Penn Wharton estimate long-term GDP gains around 0.4–0.6%, but with debt rising 3–4 percentage points and dampening investment.⁽¹¹⁾

- ING economists warn growth will be weaker than CBO estimates. The fiscal trajectory remains precarious: deficits may stay above 6% of GDP, while rising tariffs and debt crowd out growth.⁽¹³⁾

3. Sector-Specific Implications

Business Investment and Innovation

Permanent expensing and business tax relief may boost capital stock by ~0.7% and improve investment returns in the near term.⁽⁶⁾ However, private investment may be crowded out in the long run as rising rates and federal borrowing absorb loanable funds.⁽¹²⁾

Clean Energy and Public Services

The rollback of clean energy subsidies may derail progress in renewables. Reuters analysis estimates a 50% reduction in projected electricity capacity by 2035, causing consumers to pay up to $50 billion more in energy costs.⁽⁹⁾ Cuts to Medicaid and SNAP could exacerbate health disparities and pressure rural hospitals.⁽⁸⁾

4. Fiscal Sustainability and Debt Risks

Escalating Deficits and Rising Rates

Even with theoretical short-term gains, CBO and independent models forecast rising debt. Without offsetting cuts, debt could rise to as much as 183% of GDP by 2054.⁽¹²⁾

Higher deficits may trigger fiscal dominance, where monetary policy becomes subordinate to fiscal constraints, undermining the Fed’s ability to fight inflation. Rising debt-servicing costs—fueled by investor demand and inflation expectations—could crowd out spending.⁽¹⁴⁾

Potential Credit Downgrade & Sovereign Risk

ING analysts highlight that the U.S. credit rating is under pressure. If key states or foreign investors reduce Treasury purchases, yields could spike further, widening deficits and depressing growth.⁽¹³⁾

A Cato Institute critique suggests that permanent tax giveaways combined with expansive subsidies further exacerbate debt without producing commensurate long-term gains.⁽¹⁴⁾

5. Policy Trade‑Offs and Political Reactions

Redistribution and Inequality

Analysis from The Guardian and MoneyWeek highlights that the bill skews heavily toward higher‑income households: the top 0.1% may gain more than $300,000 annually, while the poorest 20% lose benefits—effectively ushering in the largest upward wealth transfer in U.S. history.⁽⁸⁾

Electoral and Policy Backlash

House Democrats have begun town hall campaigns warning constituents that over 11 million Americans may lose Medicaid, and rural hospitals may collapse under funding drops.⁽¹⁶⁾

Critics also emphasize procedural issues: distortions in projections, exclusion of legislative changes, and overoptimistic claims about economic growth, fueling concerns that voters may penalize Republicans in the 2026 midterms.⁽¹⁷⁾

6. Market Reaction and Investor Sentiment

Surprisingly, markets have shown limited immediate fallout. In the Robert Armstrong FT podcast “Unhedged”, panelists note investors remain calm—equity markets remain stable, and bond yields have only modestly increased following the bill’s passage.⁽²⁴⁾ Some attribution is given to tariff rollbacks offering offsetting revenue inflows.⁽¹³⁾

7. What to Watch: Key Variables Ahead

Interest Rate Path and Inflation Trends

Monetary policy may face a dilemma. If inflation accelerates, the Fed may need to raise rates more than expected, increasing the cost of debt and burdening growth further. Conversely, political pressures may limit rate hikes, risking inflation persistence.

Tariffs and Trade

New tariff proposals—particularly targeting Japan and South Korea—may offset revenues but could also depress corporate profits and consumer spending. How these tensions evolve may significantly shape macro dynamics moving forward.⁽²⁴⁾

Fiscal Consolidation or Expansion

Will lawmakers revisit spending cuts or raise offsets? If deficits persist, markets may demand fiscal discipline, potentially forcing painful structural reforms.

8. Evaluating the Trade‑Off: Growth vs. Sustainability

Growth Narrative

Proponents underscore that tax certainty and immediate expensing reduce the business tax burden and encourage short-term investment. These may yield modest productivity and wage gains.⁽²,¹¹⁾

Debt Constraint

Many economists argue those gains are temporary—and mechanical debt burdens and interest costs will swamp benefits by mid‑decade.⁽¹¹,¹²⁾

In essence, the bill may produce a shallow short-term lift but cast a long shadow over fiscal credibility and economic flexibility.

Conclusion: A Fragile Fiscal Gamble

The Big Beautiful Bill represents an ambitious attempt to fuse tax relief with forceful spending reallocation—but its fiscal gamble is clear. While tax certainty and investment incentives may offer near-term lift, the long-term consequences—higher debt, weaker growth, rising rates, and social welfare erosion—loom large.